Fintech App Development Company

- Devstree IT Solutions

- App

- Fintech App Development Company

Devstree IT Solution UK- The Most Trusted Fintech App Development Company in UK

Fintech Software Development Services

For financial products such as digital wallets, banking, payment apps, payment processing systems., Devstree IT Solution offers full custom software development services.

Financial Software Development

Our finance software development service experts have a good track record of providing distinctive and original financial software solutions that digitally alter your business to ensure uninterrupted growth.

Mobile Banking Software Development

We are a unique banking software and mobile banking app development firm that provides retail, commercial, and investment banks worldwide with scalable custom banking software solutions.

Wealth Management Software Development

As a FinTech app development company, we are well aware of the significance of safe and effective financial management. Your clients now have an intelligent platform to measure, manage, and increase their money thanks to our FinTech app developers.

Accounting Management Software Development

We offer much more than just daily financial transaction management with our unique accounting management software solutions. As a reputable Finance Software Development Company, we create reliable accounting management software that safely stores and organizes financial data.

Crowdfunding Platform Development

We also provide scalable crowdfunding platforms with high-end features like digital document management, social networking tools, and investment tracking for debt, donation, and fundraising purposes as part of our FinTech app development services.

Mobile Payment App Development

Our financial software engineers provide mobile payment apps that are secured and safe from start to finish, enabling easy rewards, payments, and mobile money transfers.

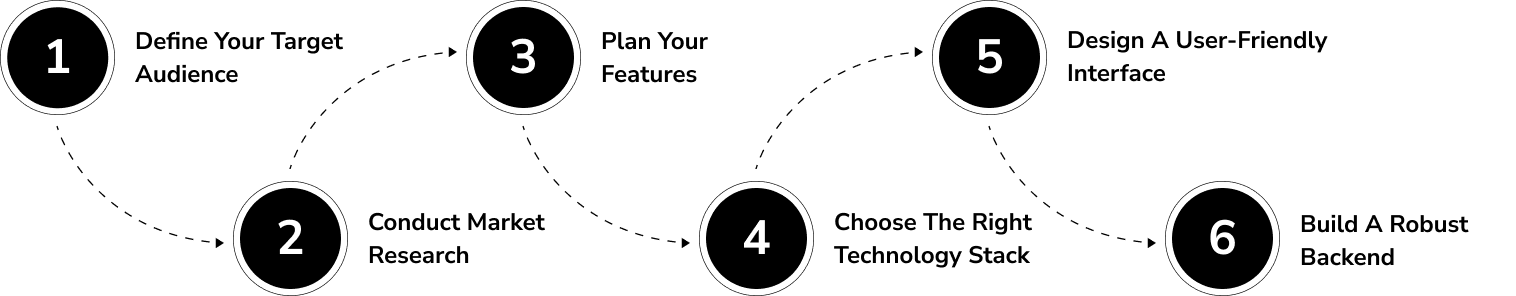

Our Fintech App Development Process

OUR APPROACH

Why Choose Us?

We at Devstree IT Solution UK provide FinTech solution development to transform your audacious concepts into cutting-edge goods. We weave together our software development methodology with our client’s visions to empower them to continue enjoying this edge.

As a FinTech application development company, we know exactly how to make innovation work for your business and position your company at a distinction from the competitors. We have completely met the expectations placed by our customers while keeping the projects within budget, by providing specialized FinTech IT solutions in digital banking, payment and investment management, cryptocurrency, trading, and crowdfunding.

Want To Build your on Fintech app?

The Key Features

Fintech App Development

Easy User Account Management and Onboarding

This features a simple and quick registration process with reliable authentication techniques. It should be simple for users to access account settings, update information, and manage their profiles.

Monitoring transactions in real-time

Instant notifications enable consumers to take prompt action to reduce potential risks by alerting them to any suspicious or odd transactions.

Simple Instruments for Financial Management

Give consumers the tools they need to manage their budgets, costs, and income. Provide functionalities such as financial goal setting, bill pay, and classification.

Financial insights and recommendations driven by AI

Utilize AI to produce individualized financial insights by analyzing user data. Based on each person's needs, suggest investing options, savings targets, or budgeting techniques.

Advanced Security Protocols

Carry out such highlights as data encryption, multifaceted validation, and continuous fraud detection to safeguard client information and financial transactions.

Features of Investment and Wealth Management

Provide users the option to make direct investments in stocks, bonds, and other financial products through the app. Provide resources for managing portfolios and monitoring the success of investments.

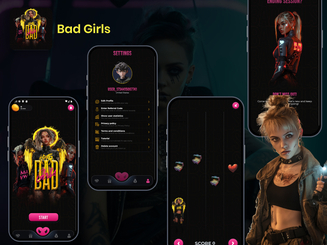

Our Other Expertise In On-Demand Solution

TESTIMONIALS

What Clients Are Saying

Peter R

Mike

Melanie